JCPenney Tackles New Audiences with “Make It Count” and NFL Sponsorship

When you think of large retailers and the NFL, what stores come to mind first? Dick’s? Walmart? Target? We’ll bet that JCPenney was not in the top-of-mind list.

Last month, JCPenney (owned by major mall operators Simon and Brookfield), said it would spend more than $1 billion by the end of 2025 to revive its stores and brand. JCPenney’s CEO Marc Rosen, who took the company’s helm in 2021 after JCPenney emerged from Chapter 11 in 2020, states the investment will be applied to making investments in sports sponsorships, remodeling JCPenney stores and upgrading its online shopping site and app.

JCPenney’s first paid NFL programming is a partnership with Amazon for the postgame program on Prime Video’s Thursday Night Football. This will either successfully be a beautiful song in the big jungle or a beautiful baby zebra that entered the lion’s den. JCPenney does best among diverse, budget conscious, middle income, HH’s with Kids.

- Amazon Prime Thursday Night’s audience includes 49% of persons 18-49 (Statista), with a household median income of $98,500 (Nielsen). This is at the top range of JCPenney’s target but lower than the NFL’s biggest viewer segment which is more affluent. Also, HH’s in this target agree that they would consider purchasing a brand based on its sponsorship of the NFL. In addition, 65% of all U.S. Amazon shoppers are Prime members.

For this sponsorship, JCPenney launched a new lifestyle campaign, “Make It Count” (See Ad). Advertising Benchmark Index™ (ABX) jumped into the analytics to examine JCPenney’s historical and recent ad performance, and whether “Make It Count” is over- or under-performing. Also, ABX has a unique insight ability to look at a test ad versus specific competitive ads, not just comparing it to a competitor’s average.

ABX is a leading ad effectiveness and consumer insights company with the largest global syndicated measurement solution that evaluates the effectiveness of ads across all media types, competitors, demographic groups and more over time/brand history.

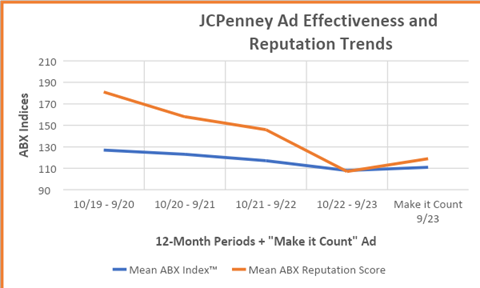

“Make It Count” vs. JCPenney Ad Performance History

JCPenney’s ad performance has been declining in recent years. TV/Video ad effectiveness for Gen Pop over the last four years showed ABX Index™ mean scores dropping from 127 to 108. Reputation scores also fell from 181 to 107. See chart below.

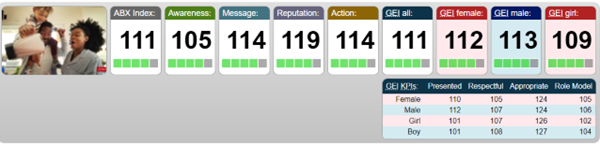

But all is not lost. The new “Make it Count” :30 ad is a strong performer at an ABX Index™ of 111 for Gen Pop and is ranked 6th out of 24 JCPenney spots in the last 12 months. The ad also scored well for Reputation at 119. In the Retail Category, however, the ad is an average performer, ranking 321 out of 641 ads in the last year. All ABX scores are based on an average of 100.

“Make It Count” vs. Target and Competitive Ads

Communication effectiveness for this effort will be all about: 1) how “Make It Count” ads perform against JC Penney target audiences; and 2) how it compares to other retailers’ lifestyle ads to enhance reputation and calls-to-action. The reason to look at lifestyle to lifestyle spot comparisons is to week out retailers’ top performing ads tied to big promotional windows like Holidays, Back-to-School and Black Friday.

When we look at “Make It Count” against JC Penney’s core target, every KPI increases exponentially vs. the Gen Pop audience. Specifically, the spot now has an ABX Index of 28% above ABX norm, and Message, Reputation, and Intended Action are even higher.

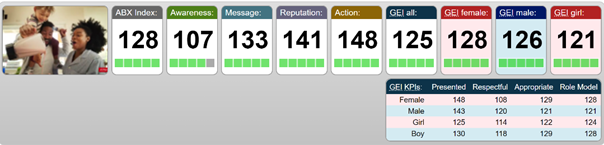

The chart below captures “Make It Count” against competitive lifestyle ads for Amazon, Walmart and Target. We looked to see if the ads had the same boost among JCPenney’s target versus Gen Pop and if the lifestyle message was able to generate action beyond image alone.

GEN POP | HH $50k-$99.9k with Kids | ||||

| RETAILER | AD LINK | ABX Index™ | Action Score | ABX Index ™ | Action Score |

Amazon “Snow Globe” | See Ad | 113 | 130 | 148 | 181 |

JCPenney “Make It Count” | See Ad | 111 | 114 | 128 | 148 |

Walmart “Make Life Better” | See Ad | 111 | 114 | 124 | 141 |

Target “Totally Target” | See Ad | 113 | 119 | 114 | 115 |

The JCPenney and Walmart ads do very well against the Middle-Income, HH’s with Kids target, resonating much stronger than they do versus the Gen Pop. They have significantly more appeal (ABX Index™) and Intended Action.

However, the Amazon ad is a “touchdown” against the HH’s with Kids, $50-$100k audience, with an ABX Index of 148 and an Action score of 181. The Target ad performed no better with this audience than with the overall population.

CONCLUSION

If JCPenney’s goal is to utilize the higher reach of the NFL to expand its story and improve its reputation against a core target audience with an engaging Brand Message, this effort looks to be quite strong creatively.

Written by Marc Rappin, Advertising Consultant & Contributing Writer, former CMO of ARF