Special Guest Michael Wolfe, CEO of Bottom-Line Analytics, repurposes his recent article on advertising effectiveness through the efficacy of different Television spot lengths. If you’ve followed the ABX Advisory, you’ve seen a number of articles from Michael utilizing his vast talents in market mix modeling to yield best practices for advertisers.

Using Television Spot Lengths Wisely by Product Type

In the TV spot world, buyers have different choices with respect to commercial time lengths. There is the 60-Second ad, which is diminishing in popularity due to its high cost. There are the 30- and 15-Second ads, which are more common. And there are even 10-Second and 1-Second ads, which are used as brand mentions such as, “this program is brought to you by .”

As you know, all these ads come at different costs. For example, a benchmark cost for a 30-second spot costs about $25,000, and a shorter 15-Second ad is $15,000. The critical question is: which gives you more bang for the buck?

In this paper, we will explore this issue in two ways, using analytic models as well as ABX ad effectiveness copy test results, to provide deeper context to our analytic models.

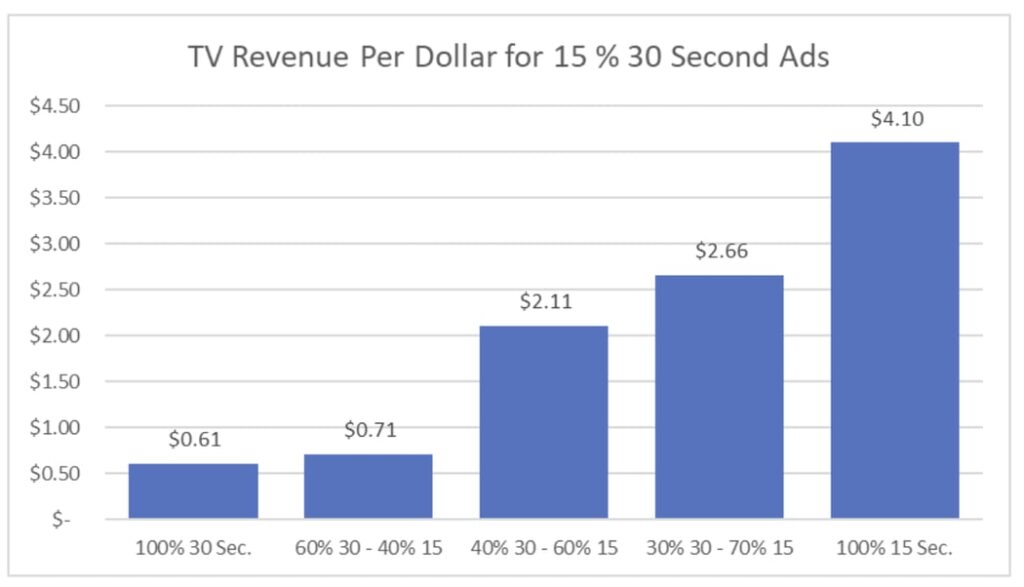

Our first Example charted below comes from marketing models for lottery tickets. Lottery tickets are mostly sold in convenience stores and tend to be highly driven by impulse, advertising and jackpot levels. Price-points for purchasing a lottery ticket are mostly under $20. As the chart below indicates, the revenue generated per-dollar is significantly higher the more 15-Second ads are in the media mix.

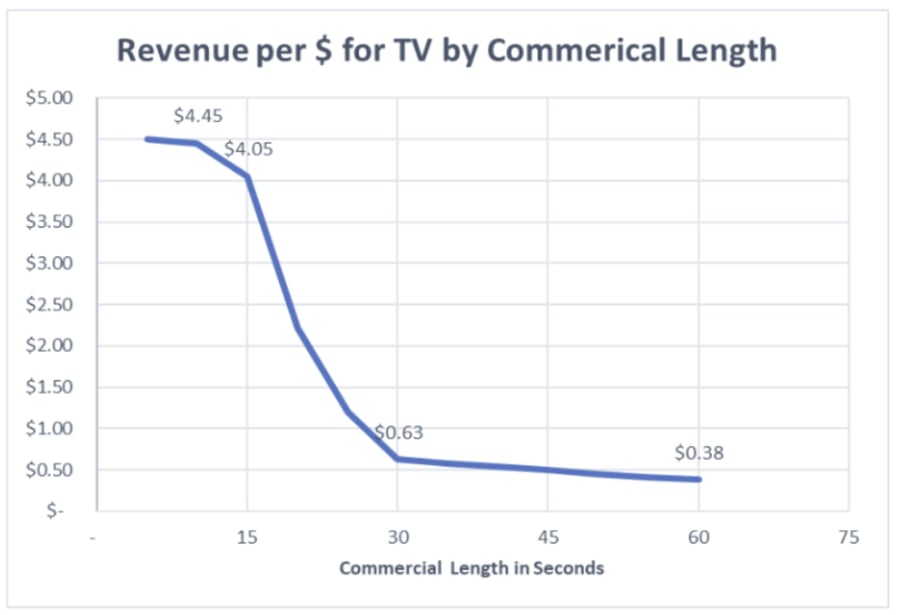

The second Example comes from a fast-moving Consumer-Goods brand. Here, there was a wider range of Television spot lengths in their media-mix. Like lottery tickets, this tended to be a lower price-point and often impulse-driven purchase. As shown below, the smaller the length of the TV ad, the larger the revenue per-dollar spend. However, only small improvements are found for lengths under 15-seconds; and there is only a small reduction between 30-and longer 60 -second ads.

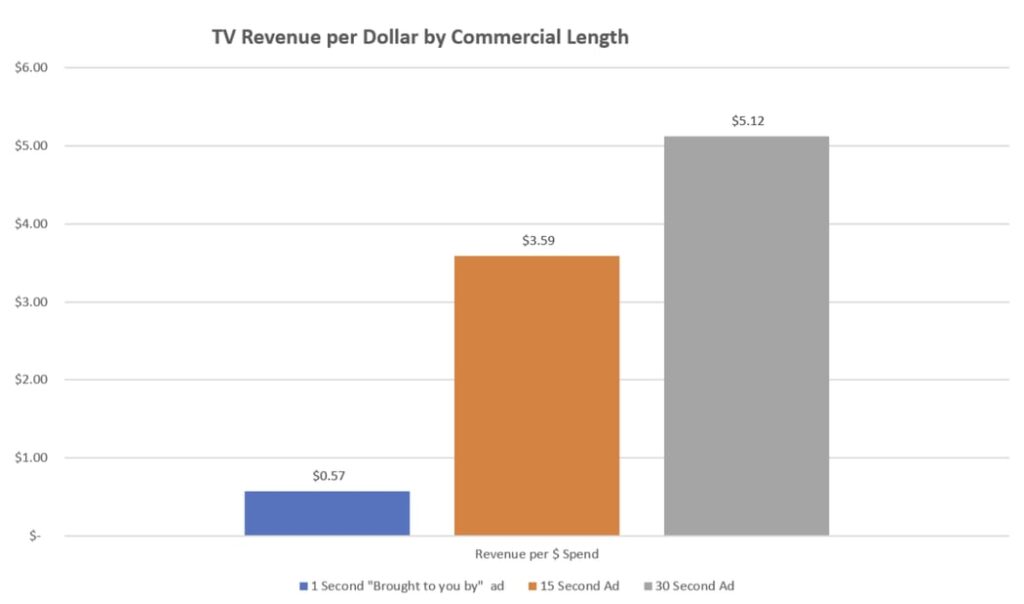

While shorter-duration TV ads are more effective when looking at smaller price-point and impulse driven brands, we do not see these same advertising effectiveness patterns for higher priced products or services which require more thought and deliberation before a purchase decision is made. This is the case when we look at an in-home residential repair service costing more than $2,000 per incident.

As shown in the above chart, we see the opposite pattern of effectiveness across the television spot lengths. The revenue generated per-dollar, is greater across the longer 30-second TV ads! Where more customer involvement and consideration is required to arrive at a purchase decision, evidence suggests that the longer ads provide more information needed to make such a decision.

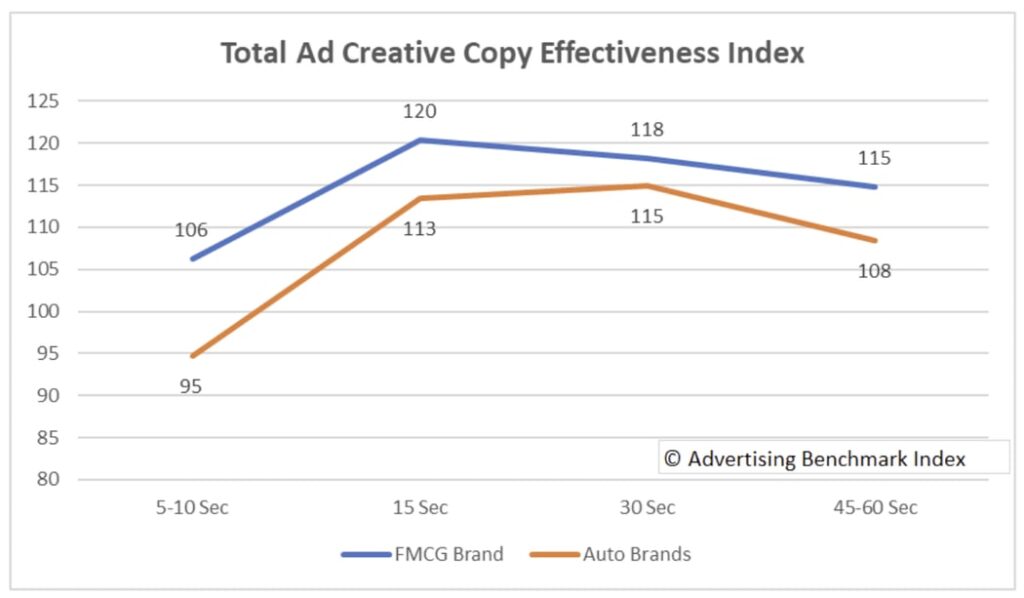

When we look at survey-based TV ad copy testing from ABX, we also see similar patterns with respect to ad effectiveness across different industry groups. In high price-point industries requiring more deliberation to arrive at a buying decision, like Automotive, longer TV ads fare better. In contrast, the more impulse-driven FMCG consumer brands are better suited for the shorter-duration 15-second ads, but not for the ultra-short duration 5- to 10-second ads.

Improving Advertising Effectiveness and Efficiency

Advertisers can improve the efficiency of their TV advertising by adjusting the lengths of their commercial placements. If your brand is a product with lower price-points and is more driven by impulse buying, you should probably increase your spending-mix towards shorter 15-second ads. Higher-priced goods, where information and deliberation are part of the buying decision, should bend more towards the longer 30-second TV ads.

While the information shared here leads to some viable principles, we believe all brands should do their own testing and analytics to arrive at their own conclusions. A lot of what is written on this subject is focused more on the moving of advertisers solely to the shorter ads. We do not believe this is a “one-size fits-all-decision.” It is worth the effort for the advertiser to do their own research and analysis to arrive at a decision.

Michael Wolfe, CEO of Bottom-Line Analytics, brings about 30 years of direct experience in marketing analytics on the client, ad-agency and consulting sides. On the former, Michael worked for Coca-Cola, Kraft Foods, Kellogg’s and Fisher-Price. He has also consulted with such blue-chip firms as AT&T, McDonald’s, Coca-Cola, Hyatt Corp., L’Oreal, FedEx and Starbucks. Michael has broad experience in marketing analytics covering marketing ROI modeling, social media analytics, pricing and brand strategy; and he has numerous articles on these subjects.