This is our fifth year of reviewing the effectiveness of Super Bowl advertising. Our primary source for advertising testing continues to be from Advertising Benchmark Index (ABX). This year, we have added a comparison between Super Bowl and World Cup.

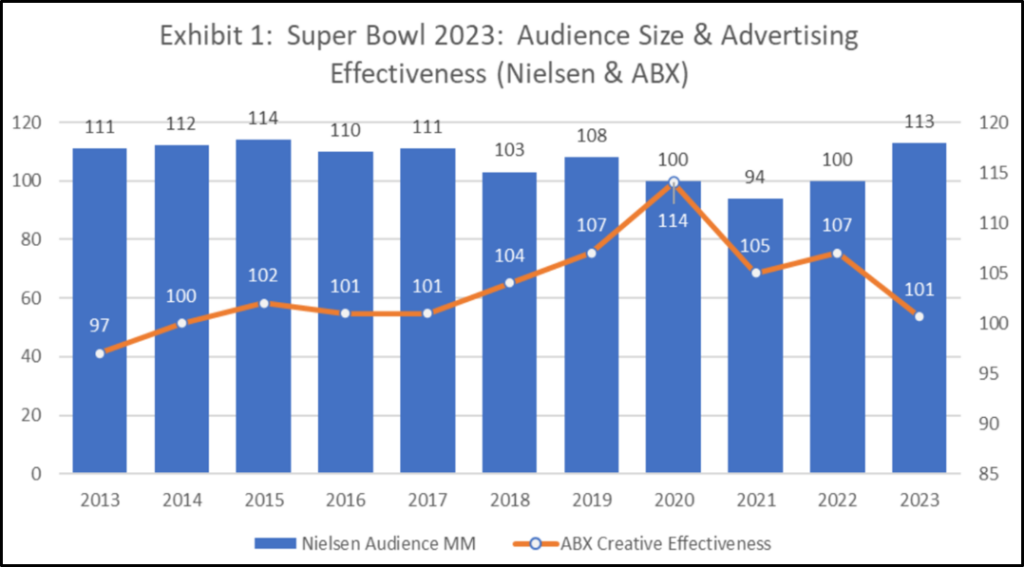

The 2023 Super Bowl was a mixed bag in terms of overall performance. Viewership of the game rebounded from its prior low to 113 million, the second-most ever. On the other hand, advertising effectiveness posted a 6-point decline to 101. For various reasons, these ads did not resonate well with consumers. In addition, fewer Super Bowl ads were aired in this year’s game. Does this spell trouble for the year ahead?

William Burns, Founder & CEO of Ideasicle X, and a former advertising contributor to Forbes, would certainly agree. In his recent press release, “Ideasicle X Challenges Super Bowl Advertisers In 2024 To Focus On The Idea” he wrote, “I couldn’t believe I was sitting through yet another year of lame Super Bowl spots. I mean, some were ok, but high school marketing club wrote them”.

Indeed, for the past 4 years, Super Bowl ad effectiveness has been trending down. Exhibit 1 below shows these trends.

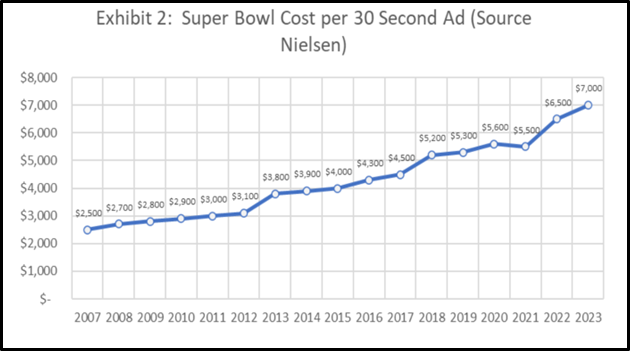

Ongoing Rising Costs Of Super Bowl Advertising

The question is: does Super Bowl advertising deliver value? As Exhibit 2 shows, increasing costs for these ads have accelerated over the past two years and are likely to continue along this path. It is still the big enchilada of advertising reach, but are we reaching the saturation point of consumer interest? When we look at the inflationary cost of a 30-second Super Bowl ad, and declining ad effectiveness, are advertisers going to continue to participate in Super Bowl advertising?

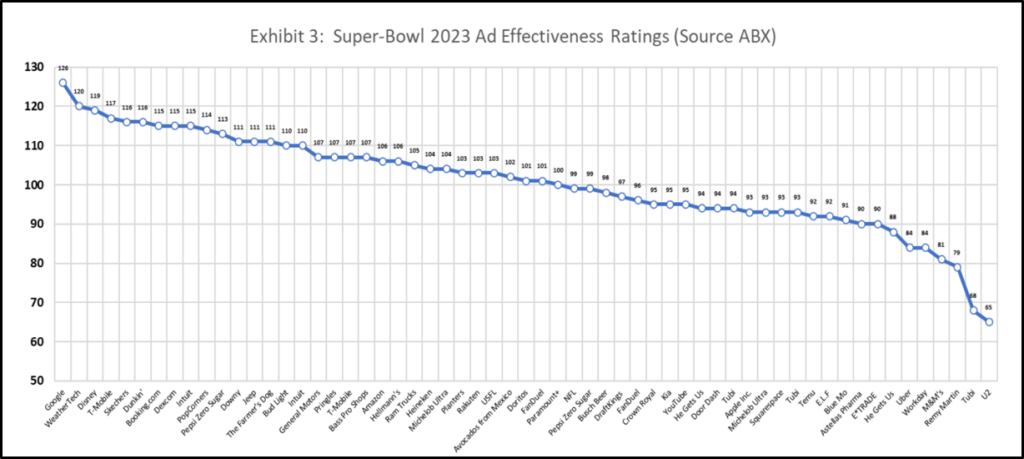

In 2023, ABX assessed 59 ads, a reduction from the 67 tested in 2022. The reduction in the number of ads could signal trouble for the NFL and its ability to fetch the higher and rising costs of the ads going forward. Long-time sponsors such as Anheuser-Bush are dropping out. In Exhibit 3, we see the span and distribution of effectiveness scores for the 59 tested ads. In 2023, 27 of these ads (45%) registered scores below the advertising norm. In the 2022 Super Bowl, just 14 ads (21%) fell below the 100 norms.

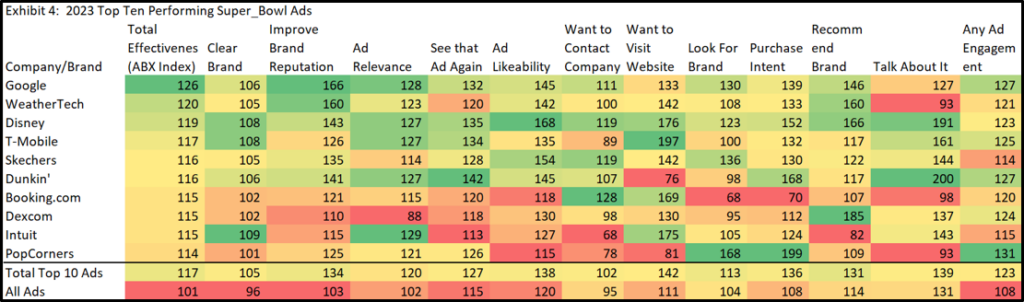

Top Performing Super Bowl Ads

The color key is to understand the chart above: dark red = lowest scoring ads per KPI; dark green = highest scoring; and yellow = scores in-between. Degrees of shading indicates whether ads are closer or farther away from best and worst.

To fully understand what aspects of a Super Bowl ad produces its high effectiveness rating, it is helpful to visually review each ad. Exhibit 5 below contains the links for viewing these ads.

Exhibit 5: View Top 10 Ads Company/Brand Total Effectiveness

|

||||||||||||||||||||||||

Are Super Bowl ads better than ads during other parts of the year?

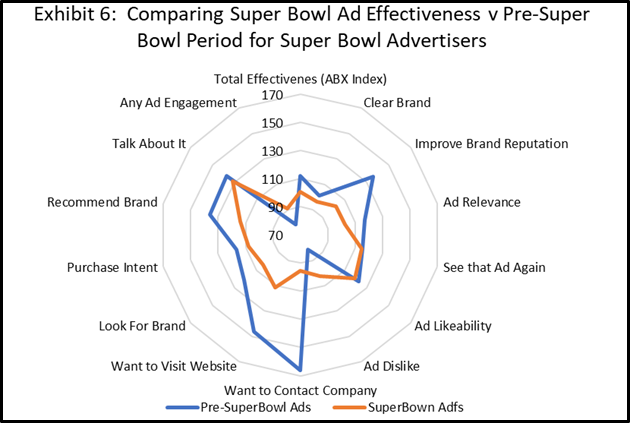

In Exhibit 6, we compare advertising effectiveness & its elements for the Super Bowl advertisers across the other parts of the year. Usually, we see superior ratings for Super Bowl ads on measures like brand reputation, ad likeability, and an interest in talking about the ads. However, we see no such patterns in 2023. In fact, for the first time in 5 years, the Super Bowl advertisers’ effectiveness scores for their Super Bowl ads were significantly below their scores during other parts of the year (101 v. 112).

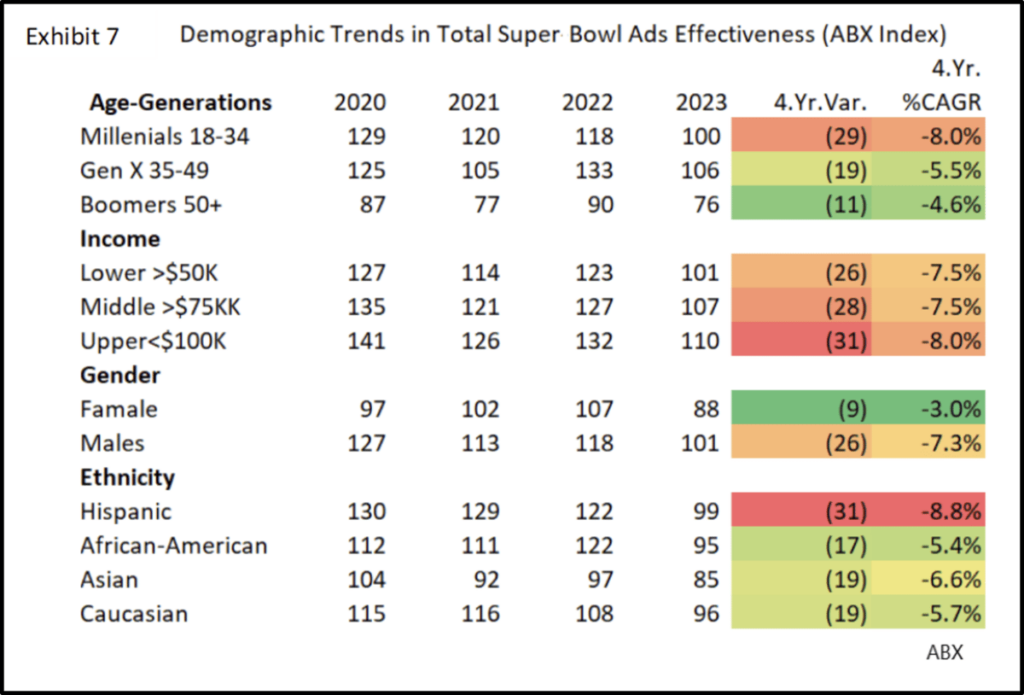

Super Bowl Ad Effectiveness across Demographic Groups

Exhibit 7 shows declining effectiveness across all groups since 2020. Across age groups, Boomers rate Super Bowl ads significantly lower than other groups. The younger Millennial group shows the largest drop in how they rate Super Bowl ads. While Males significantly rate Super Bowl ads higher than Females, they have shown a greater drop in their ratings since 2020.

Ad Effectiveness: Comparing the Two Largest Sports Properties

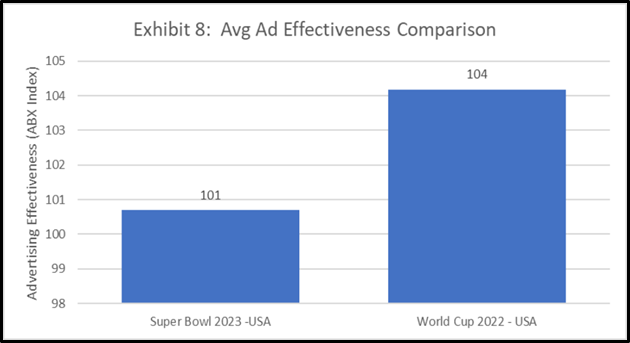

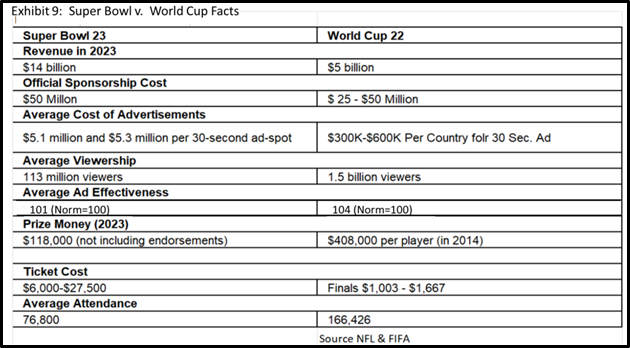

Super Bowl and World Cup are, by far, the largest & most lucrative sporting events on the planet. Certainly, it would be good for marketers to know how Super Bowl and World Cup compare on advertising effectiveness. Multinational Firms like Visa, Coca-Cola, Burger King & McDonald’s have migrated more to World Cup in recent years or have pulled out of the Super Bowl during the year of World Cup. Surely, these two events are competing for ad dollars. In Exhibit 8 we see that Super Bowl 2023’s ad effectiveness under-performed relative to World Cup.

Still, the differences and complexity of comparing these two events drive us to different contexts. The Super Bowl is played more often and delivers 100 million viewers. It is well-positioned to deliver reach & penetration for new products and low-awareness brands. By contrast, World Cup is unmatched in terms of the number of total viewers and is perfectly designed for large multinational brands.

Conclusion

This white paper has uncovered some somewhat disturbing information on Super Bowl 2023’s advertising effectiveness. To put it mildly, the advertising in Super Bowl 2023 under-performed expectations. Across many dimensions, we found a decline in ad effectiveness:

- When comparing ad effectiveness versus 2022.

- When comparing the ad effectiveness scores of the top 10 ads versus the same group of the prior year.

- When comparing Super Bowl advertisers’ effectiveness compared to other times of the year.

- When counting the significantly larger group of under-performing ads (below 100 norm) versus the prior year.

- When comparing current performance versus prior years across all major demographic groups.

- When comparing Super Bowl effectiveness versus other sports properties such as World Cup.

- All of this, coupled with fewer ads being sold for the Super Bowl in 2023, could spell trouble next year.

The depth of this creative underperformance should raise a yellow flag because it raises the possibility that consumers could be getting burned out by the glitz and hype of Super Bowl advertising.

We conclude this with a quote. “I found the majority of the Super Bowl ads to be particularly bad this year. Safe, lazy, boring.” said Douglas Brundage, founder of Kingsland, over email. “It seems as if brands are still figuring out what the national mood is and choosing the most conservative routes possible instead of doing the deep strategy work to unlock an opportunity. I hate to see brands waste money like this.”

Michael Wolfe, Bottom-Line Analytics LLC

Angie Jeffrey, Advertising Benchmark Index, ABX